Managing 2023 Medicaid Changes State-by-State, Client-by-Client, Patient-by-Patient

In the spring of 2020, Congress passed the “Medicaid continuous coverage requirement,” which asserted that all states were required to keep Medicaid enrollees in the program until the end of the public health emergency (PHE) related to COVID. In December of 2022, Congress advised that the Medicaid continuous coverage requirement would be winding down. As early as February of this year, many states started reviewing Medicaid enrollees for benefits. As a result of this “back to business” adjustment, sources indicate that 15-20 million Medicaid beneficiaries are at risk of losing coverage, and hospitals are at risk of losing Medicaid reimbursement revenue for previously eligible patients.

We asked Invicta’s Senior Vice President of Operations, Tiffany Echevarria, to provide an update and some added context for medical providers, individuals and families in general that may be affected.

Tiffany Echevarria

Senior Vice President, Operations

What does all of this really mean?

In 2020 at the height of the COVID pandemic, the Centers for Medicare & Medicaid Services (CMS) temporarily waived certain Medicaid and Children’s Health Insurance Program (CHIP) requirements. Now that Congress has required the “winding down” of the waiver of certain requirements and conditions to protect children and families during a critical time in our Country, some individuals who were qualified could lose coverage. Once the continuous coverage requirements under this program end, all states will return to their previous standard Medicaid review and coverage period.

Will/have individuals be notified by their respective state administrations that they must re-enroll to maintain their eligibility?

It has been our experience with the many patients with which we help and advocate through our clients utilizing our Enrollment Services that each state is routinely issuing reminder notification by mail to advise individuals if their Medicaid coverage may be affected. CMS is actively working with each state and other partners to advise people to renew their coverage and/or explore other available health insurance options if they no longer qualify for Medicaid or CHIP.

What is lost if someone’s Medicaid coverage is terminated?

As our healthcare system clients know, families may lose access to essential benefits, coverage, and a variety of financial assistance options that help them stay healthy and address health issues. Medicaid eligibility is determined by many factors including family circumstances, assets, and income. Children and pregnant women are generally eligible with a higher family income than other adults. Further, if we find that an individual is no longer eligible, there may be other programs to which we can refer them for assistance.

Are all states on the same timeline in terms of when they start issuing terminations due to procedural reasons?

No. Each state is different. For example, Arizona, Arkansas, and Idaho will start issuing terminations this month. Connecticut and Florida will begin to issue terminations in May, and Georgia, Texas, and Tennessee will start doing so in June. Medicaid has provided a state-by-state list that shows when each state will start issuing renewals and terminations: https://www.medicaid.gov/resources-for-states/downloads/ant-2023-time-init-unwin-reltd-ren-02242023.pdf.

Our goal is to get as far ahead of the process as possible to support our clients and their patients.

If a Medicaid or CHIP beneficiary reports a change in circumstances, will the applicable state redetermine eligibility based on the change in circumstances or is a full renewal needed?

A: The state in question may be able to redetermine eligibility based on a change in circumstances in limited circumstances. If the beneficiary is no longer within an eligibility period, the state must complete a full renewal and may not redetermine eligibility based only on a change in circumstances during the unwinding period. States may wait to process a change in circumstances pending a full renewal. That said, it is better to stay ahead of the transition!

What role does Invicta play?

Invicta Health Solutions, in partnership with our hospital clients, can assist with redeterminations for Medicaid. Individuals may contact an Enrollment Specialist at invicta@invictahs.com now for further information. With a team of tenured Enrollment Specialists, we are actively assisting our current hospital clients in engaging with individuals to remind them to re-enroll based on their circumstances. For providers that are not current clients, we are available to answer questions and ready to deploy our proven process in assisting patient re-enrollment.

How does Invicta approach patient engagement for this time-sensitive Enrollment need?

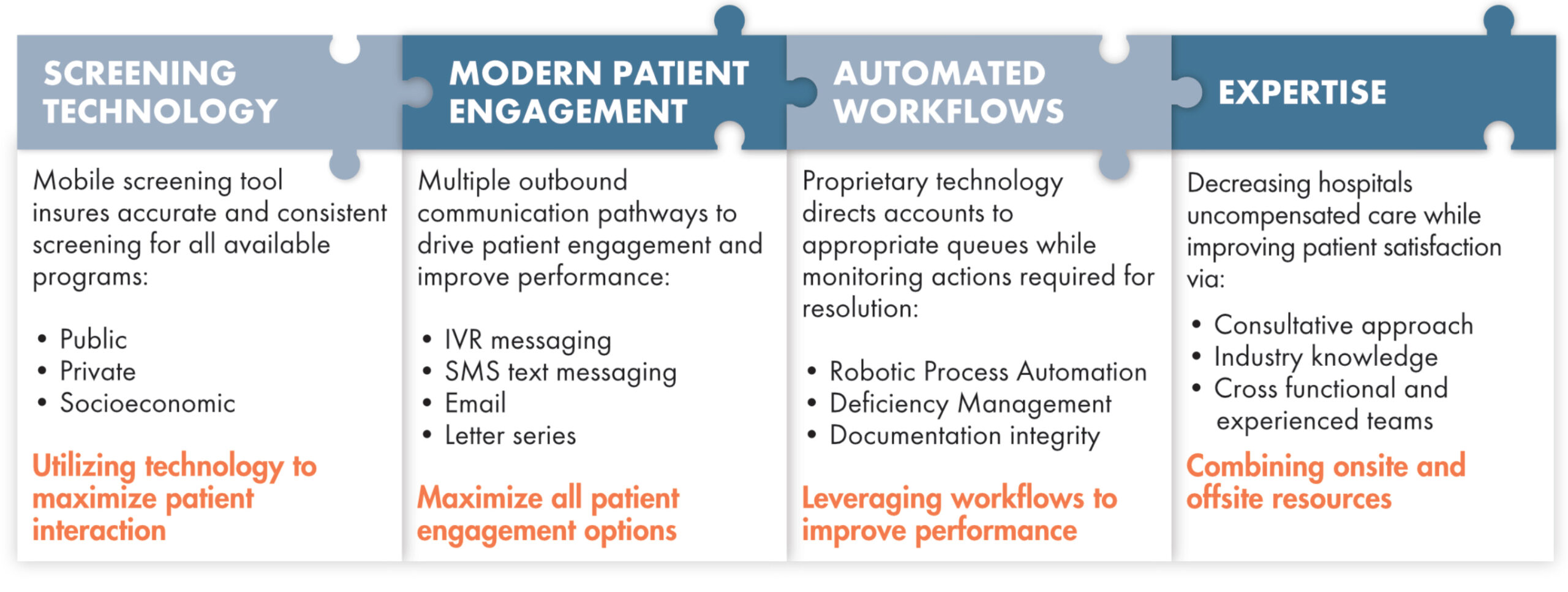

Invicta’s seamless integration of call, mail, email, IVR and text/SMS capabilities have been organized under a single platform that can be utilized concurrently by end users. This best-in-class structure maximizes both our efficiency and patient response rates in the Enrollment space. Our approach supports patients throughout the application process, elevating patient experience and maximizing program utilization. In short, we exhaust all avenues and explore all opportunities for coverage regardless of whether we are on-site or remote.

Final thoughts?

As one of our Client Services Directors frequently says, “We Got This,” and our clients know it. Invicta works with some of the largest systems as well as small ones across the United States. We are open to ideas that challenge conventional views and drive innovation, and our “innovate and automate” approach is actively scanning the environment so that our people can improve operational and financial performance for our clients. When we saw this Medicaid change coming, we began preparing. We are here to help, and ready to work!

In the spring of 2020, Congress passed the “Medicaid continuous coverage requirement,” which asserted that all states were required to keep Medicaid enrollees in the program until the end of the public health emergency (PHE) related to COVID. In December of 2022, Congress advised that the Medicaid continuous coverage requirement would be winding down. As early as February of this year, many states started reviewing Medicaid enrollees for benefits. As a result of this “back to business” adjustment, sources indicate that 15-20 million Medicaid beneficiaries are at risk of losing coverage, and hospitals are at risk of losing Medicaid reimbursement revenue for previously eligible patients.

We asked Invicta’s Senior Vice President of Operations, Tiffany Echevarria, to provide an update and some added context for medical providers, individuals and families in general that may be affected.

Tiffany Echevarria

Senior Vice President, Operations

In 2020 at the height of the COVID pandemic, the Centers for Medicare & Medicaid Services (CMS) temporarily waived certain Medicaid and Children’s Health Insurance Program (CHIP) requirements. Now that Congress has required the “winding down” of the waiver of certain requirements and conditions to protect children and families during a critical time in our Country, some individuals who were qualified could lose coverage. Once the continuous coverage requirements under this program end, all states will return to their previous standard Medicaid review and coverage period.

Will/have individuals be notified by their respective state administrations that they must re-enroll to maintain their eligibility?

It has been our experience with the many patients with which we help and advocate through our clients utilizing our Enrollment Services that each state is routinely issuing reminder notification by mail to advise individuals if their Medicaid coverage may be affected. CMS is actively working with each state and other partners to advise people to renew their coverage and/or explore other available health insurance options if they no longer qualify for Medicaid or CHIP.

What is lost if someone’s Medicaid coverage is terminated?

As our healthcare system clients know, families may lose access to essential benefits, coverage, and a variety of financial assistance options that help them stay healthy and address health issues. Medicaid eligibility is determined by many factors including family circumstances, assets, and income. Children and pregnant women are generally eligible with a higher family income than other adults. Further, if we find that an individual is no longer eligible, there may be other programs to which we can refer them for assistance.

Are all states on the same timeline in terms of when they start issuing terminations due to procedural reasons?

No. Each state is different. For example, Arizona, Arkansas, and Idaho will start issuing terminations this month. Connecticut and Florida will begin to issue terminations in May, and Georgia, Texas, and Tennessee will start doing so in June. Medicaid has provided a state-by-state list that shows when each state will start issuing renewals and terminations: https://www.medicaid.gov/resources-for-states/downloads/ant-2023-time-init-unwin-reltd-ren-02242023.pdf.

Our goal is to get as far ahead of the process as possible to support our clients and their patients.

If a Medicaid or CHIP beneficiary reports a change in circumstances, will the applicable state redetermine eligibility based on the change in circumstances or is a full renewal needed?

A: The state in question may be able to redetermine eligibility based on a change in circumstances in limited circumstances. If the beneficiary is no longer within an eligibility period, the state must complete a full renewal and may not redetermine eligibility based only on a change in circumstances during the unwinding period. States may wait to process a change in circumstances pending a full renewal. That said, it is better to stay ahead of the transition!

Invicta Health Solutions, in partnership with our hospital clients, can assist with redeterminations for Medicaid. Individuals may contact an Enrollment Specialist at invicta@invictahs.com now for further information. With a team of tenured Enrollment Specialists, we are actively assisting our current hospital clients in engaging with individuals to remind them to re-enroll based on their circumstances. For providers that are not current clients, we are available to answer questions and ready to deploy our proven process in assisting patient re-enrollment.

How does Invicta approach patient engagement for this time-sensitive Enrollment need?

Invicta’s seamless integration of call, mail, email, IVR and text/SMS capabilities have been organized under a single platform that can be utilized concurrently by end users. This best-in-class structure maximizes both our efficiency and patient response rates in the Enrollment space. Our approach supports patients throughout the application process, elevating patient experience and maximizing program utilization. In short, we exhaust all avenues and explore all opportunities for coverage regardless of whether we are on-site or remote.

Final thoughts?

As one of our Client Services Directors frequently says, “We Got This,” and our clients know it. Invicta works with some of the largest systems as well as small ones across the United States. We are open to ideas that challenge conventional views and drive innovation, and our “innovate and automate” approach is actively scanning the environment so that our people can improve operational and financial performance for our clients. When we saw this Medicaid change coming, we began preparing. We are here to help, and ready to work!